A common 'wisdom' in the NFT art community is that minting too many pieces can lower the value of an artist's work because scarcity drives prices. This week I crunched the data to find out if that was true 👇

I pulled the primary and secondary sales data for every artist on SuperRare who has ever made a sale. (Credit: Big thanks to @keeganead, SuperRare Data Archmage 🧙 for helping match users to wallets)

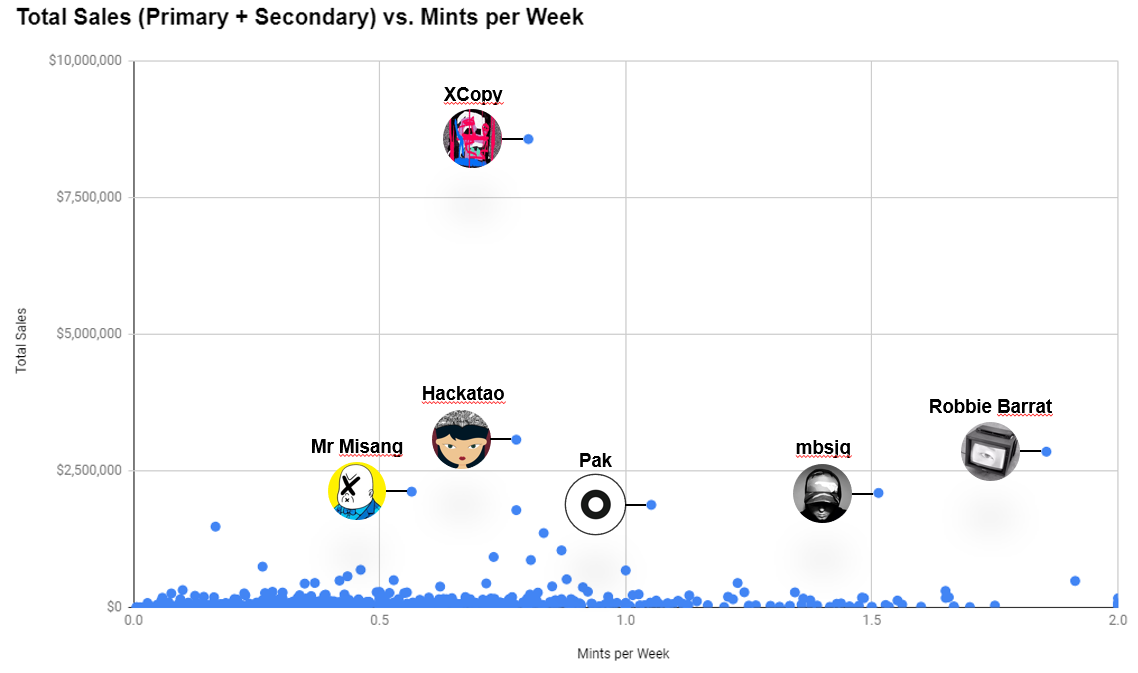

There was no correlation between how often an artist minted work and their total sales. In fact, 7 of the top 10 artists by total sales (primary + secondary) had a mintrate in the upper quartile (upper quartile was 0.63+ mints per week for this sample group). This means they sat in the top 25% for mints per week.

Why would it be the case that artists who produce more work can achieve great success despite lowering scarcity? I think @artnome summarized the case perfectly in his writing on abundance and NFT art:

- “They have established familiarity and brand by sharing a steady stream of work over time.”

- “They have produced a large enough number of works to support the creation of collections by more than a handful of collectors.”

- “Artists who produce more art learn and improve faster through steady practice.”

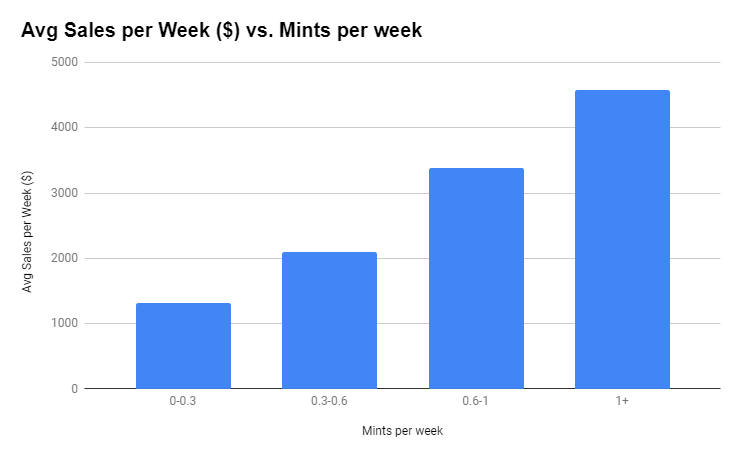

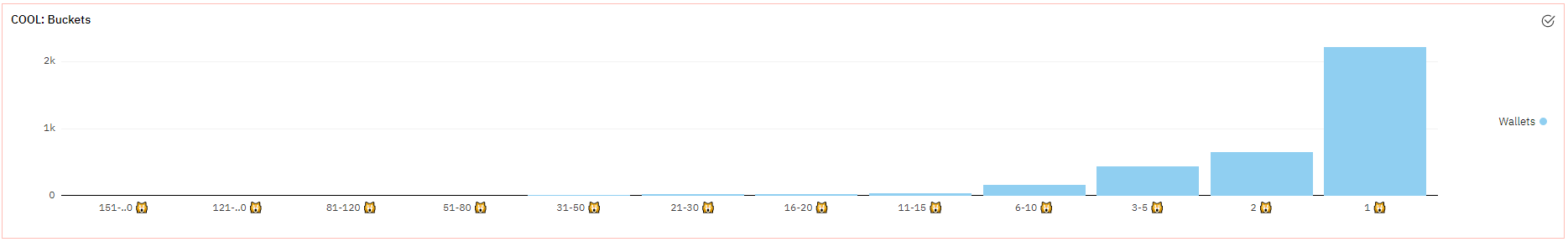

Breaking down mintrate into buckets, we see a similar trend. Contrary to popular belief, artists who produce more art are doing comparatively well in terms of sales.

Correlation isn't causation. This data does not mean that minting more art will guarantee success. It simply indicates that, despite conventional wisdom, minting more work will not prevent an artist from succeeding.

Also, this data only applies to NFT art. The same trends will not apply to collectables, game items and other categories of NFTs because those markets operate differently. It's definitely possible to have too many mints of a collectable or of an in-game item.

This breakdown was inspired by @artnome’s amazing writing on scarcity and success in the art world. If you’d like to learn more about the topic, check out this article 👇

Parameters: In this breakdown, the 'weeks' portion of mints per week was defined as the number of weeks that had passed since the artist minted their first work on SuperRare.

Generative Collectables

It’s impossible to ignore the collectables market right now. The zoo of generative animal profile pictures that dominate NFT Twitter expands every week as more and more teams copy-paste the Bored Ape playbook in search of similar success.

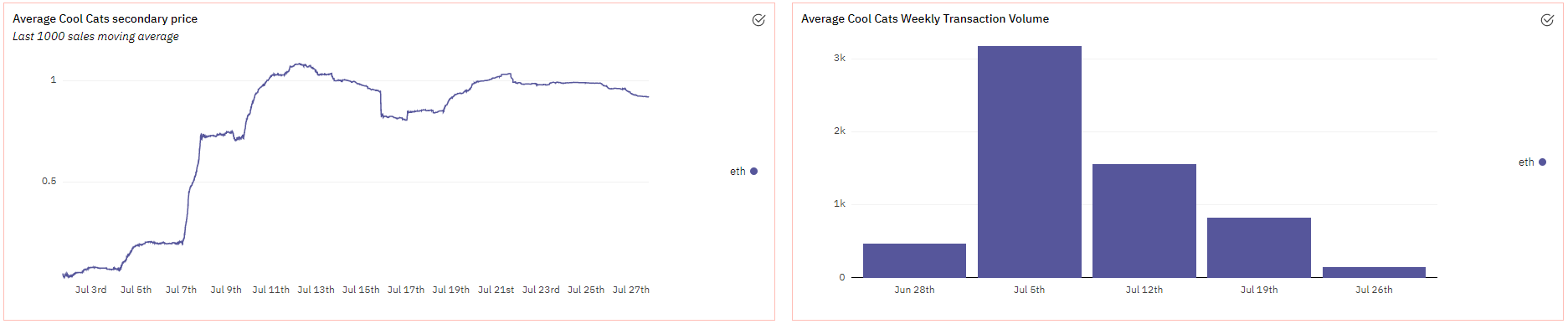

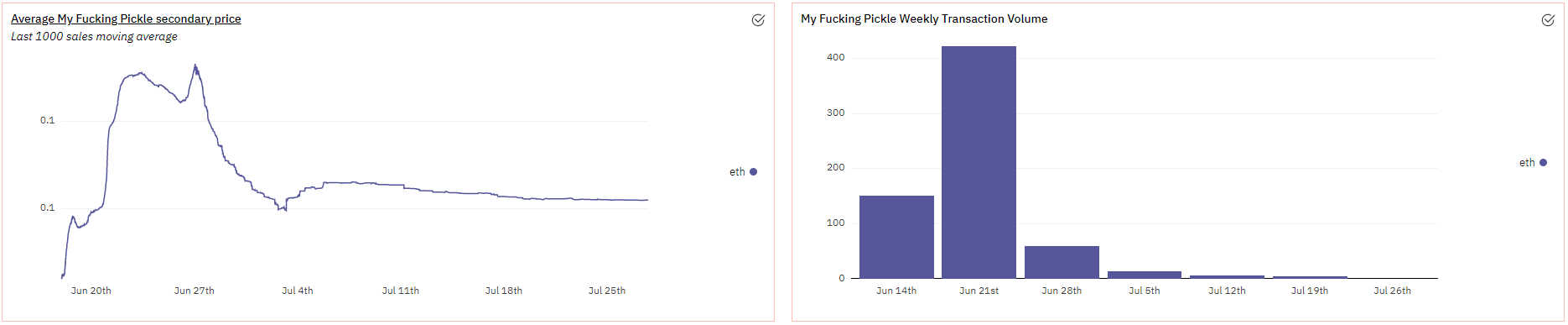

I made a live dashboard tracking the average prices and weekly transaction volumes of some of the most popular generative avatar projects (Credit: Big thanks to @richardchen39 and @drakedanner, whose work a lot of these charts are based on).

One interesting trend I have noticed is that the new-wave projects with the highest average sales prices (Apes, Cool Cats and Gutter Cats) appear to experience strong price growth despite falling weekly transaction volumes.

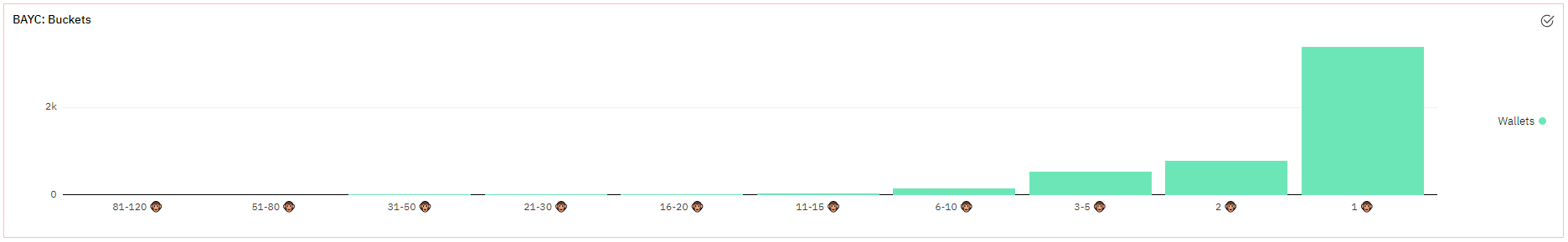

The common theme across these high performing projects is that many of their collectors use the NFTs as part of their online identity. They present on Twitter and Discord as Ape#2366 or Cool Cat#733, and they are therefore locked into not selling their holdings even as demand grows.

Note: In both the Bored Ape and Cool Cat collector bases, most collectors only own 1 NFT from the project, so they would not be able to sell one and keep another to use as their online identity.

Also, collectors using their NFT for identity purposes online is great for boosting awareness and driving demand for these winning projects.

Projects whose collectors don’t use them for identity purposes like Polymorphs (which are too ugly) or Pickles (which are too simplistic) are flipped instead of hodled and experience massive price drops they do not recover from.

I believe this touches on one of the core differences between the NFT collectables market and the NFT art market. In the NFT collectables market, identity is the product, community is the product, and the image is only as useful as its ability to facilitate those two value propositions.

Hope you found this interesting! This week I tried out a slightly different format. Two articles in the newsletter and a more narrative-driven approach than a data-driven one. Did you like or dislike the change? Let me know by leaving a comment on the Twitter thread (liking and sharing to feed the algorithm would also be great 😉):

Please do let me know what you think. I genuinely appreciate you taking the time out of your week to read my JPEG obsessed ramblings, and I aim to make the newsletter as useful as possible ⚡

Article of the Week

^Interesting article and slideshow on NFT market bucketing

Subscribe to NiftyTable

Subscribe to the newsletter and unlock access to member-only content.