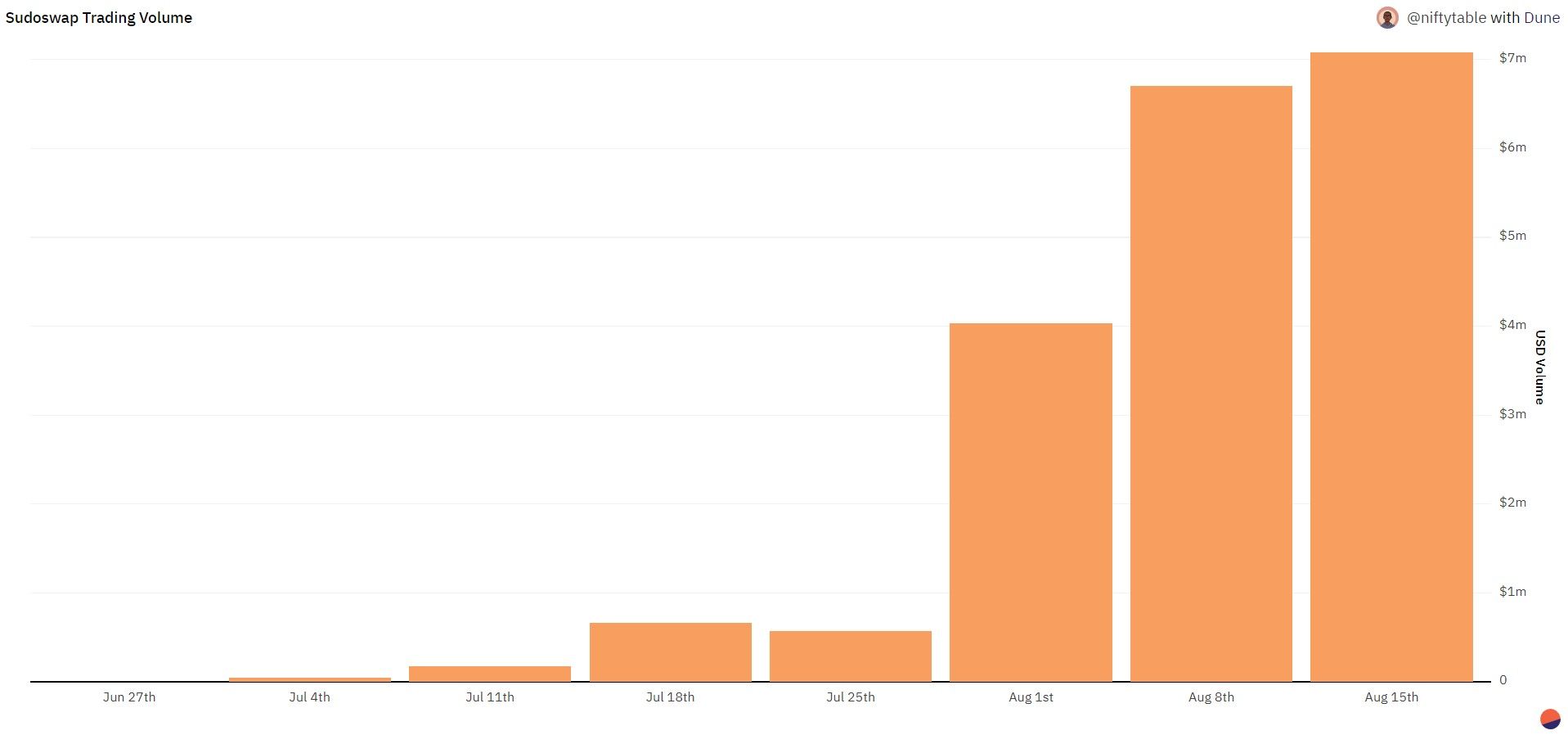

Since the launch of its NFT AMM product in July, Sudoswap has done $20M of trade volume.

Here are 5 key insights on the platform's growth, its userbase, and where the most money has been made 👇

Credit: All of these stats are based on the Sudoswap dashboard built by on-chain data extraordinaire Andrew Hong. If you're not already following his Twitter, fix that today ✨

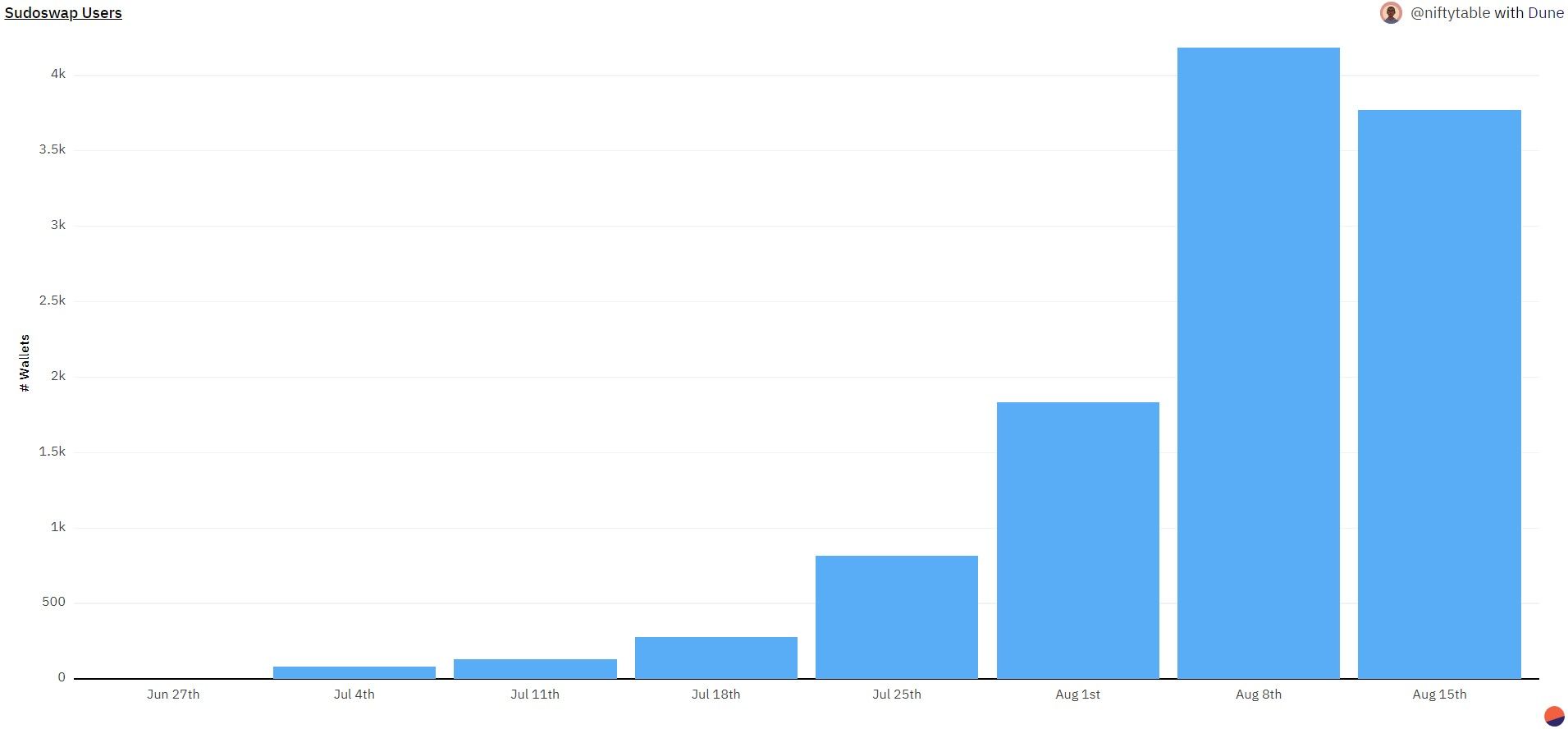

1/ 11.3k unique wallets have traded on Sudoswap.

Every past week has been a new all-time high for the active user count. This week is on track to continue that trend.

Similarly, every week has been a new all-time high for trade volume. Sudoswap is exhibiting all the tell-tale signs of an early rocketship 🚀

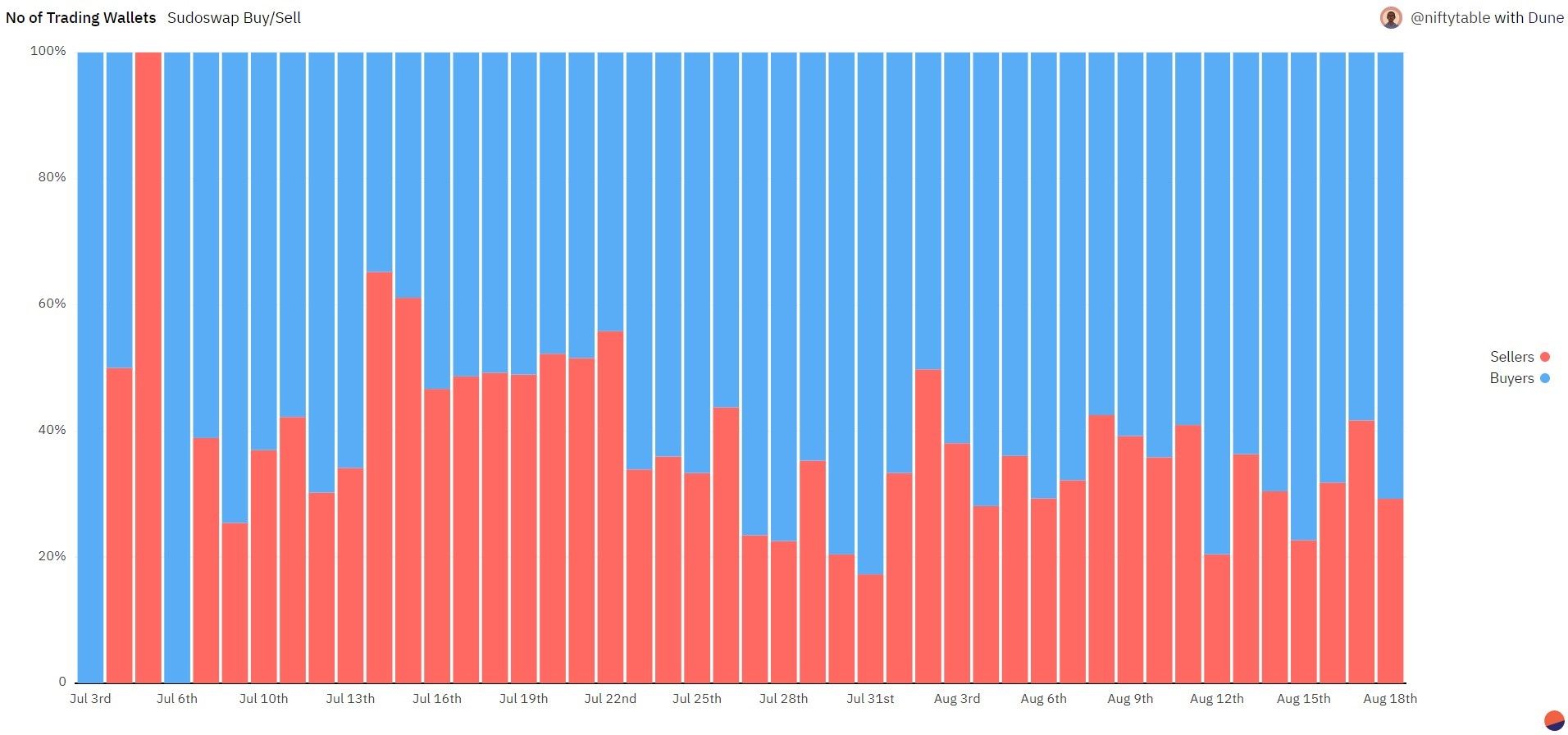

2/ Currently, the number of wallets that are making purchases on Sudoswap exceeds the number that are making sales.

3/ Sudoswap pools buy and sell NFTs.

Users who provide liquidity to those pools earn fees when trades occur in those pools.

So far, Sudoswap LPs have earned ~300ETH and the protocol has earned 54ETH

4/ The collections that have generated the highest trade volumes and protocol fees are

- Webaverse Genesis Passes: $2.34M trade volume

- BasedGhouls: $1.51M trade volume

- 8liensNFT : $1.67M trade volume

5/ The collections with the highest offer TVL (ETH locked in pools that is ready to insta-buy NFTs) are

- Oxmons: 130ETH

- CloneX: 121ETH

- Sudo Inu: 104ETH

Support

Please like and share the matching Twitter thread for visibility ⚡

Subscribe to NiftyTable

Subscribe to the newsletter and unlock access to member-only content.