$2.1B was spent on paid NFT mints in the past year.

I crunched the data on paid mints to find out how much money is being made, who is making it, and what the market trends are.

Here are 5 key insights I found 👇

Primer:

A paid mint is a sale event where people pay for the chance to publish a new NFT to the blockchain.

The buyer owns the NFT that they minted.

The revenue goes to the creator of that NFT collection.

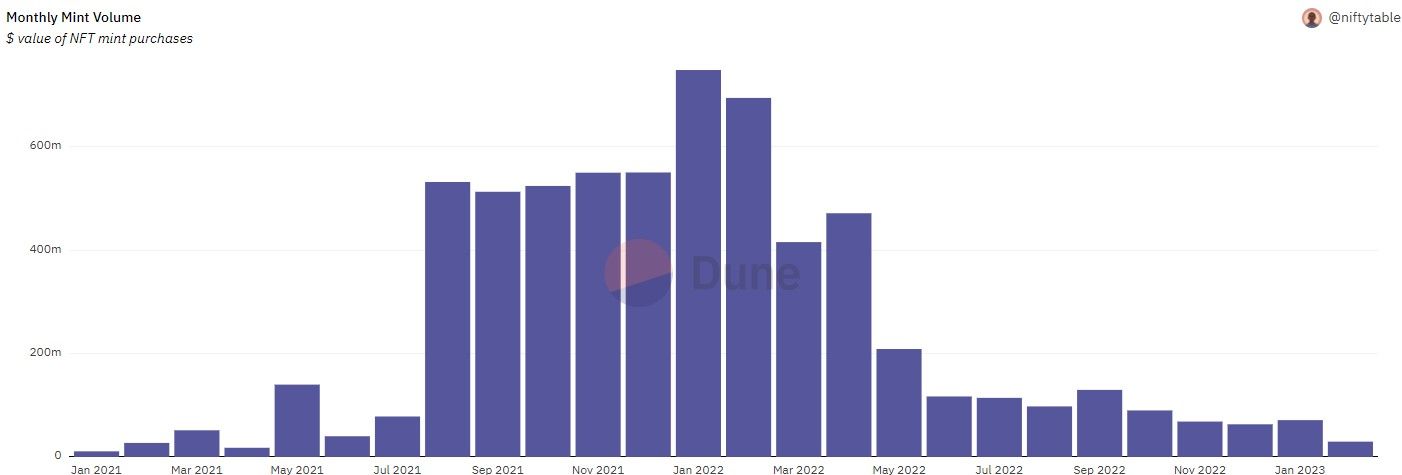

1/ In the past month, $78.7M was spent on NFT mints

2/ January 2022 was the all-time high for NFT mint volume; $749M was spent on mints that month

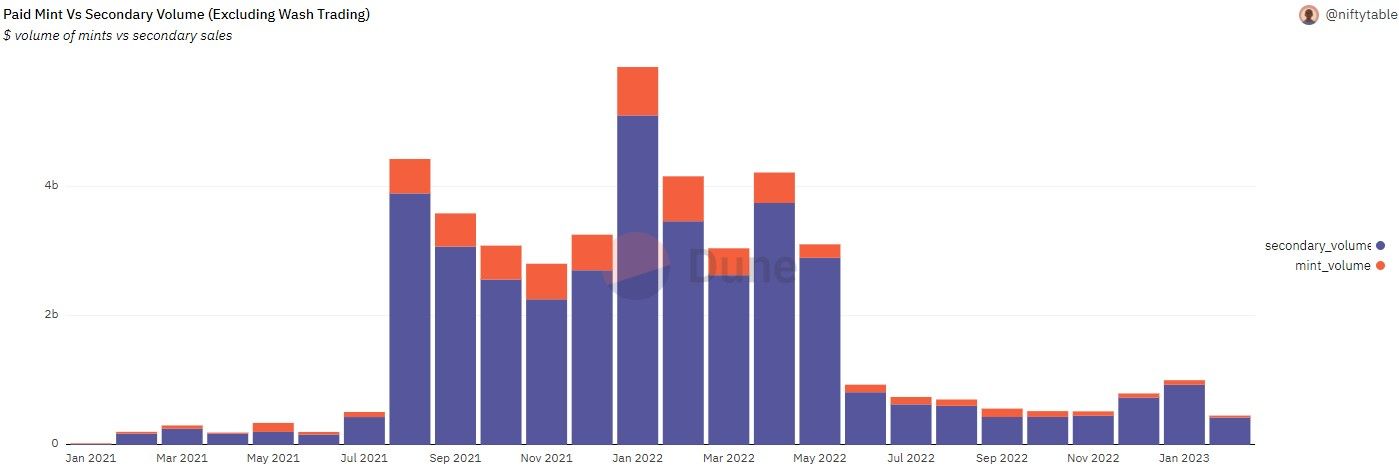

3/ Paid mints currently make up ~7% of all NFT sales volume.

I excluded wash trading from the secondary market volume using a filter developed by Archmage Hildobby 🧙🪄

4/ The top collections by mint revenue are

Artblocks V1 - $280M

Nouns - $119M

MAYC - $91M

Pixelmon - $74M

ENS - $73M

5/ These collections had the highest “average gas paid” for their mint transactions

Fatales - $10k per txn

Time - $9.7k per txn

Gevols - $9k per txn

Galaxy Eggs - $7.4k per txn

Mfers - $7k per txn

A lot of money has been wasted in NFT gas wars 😵💫

Bonus Insight:

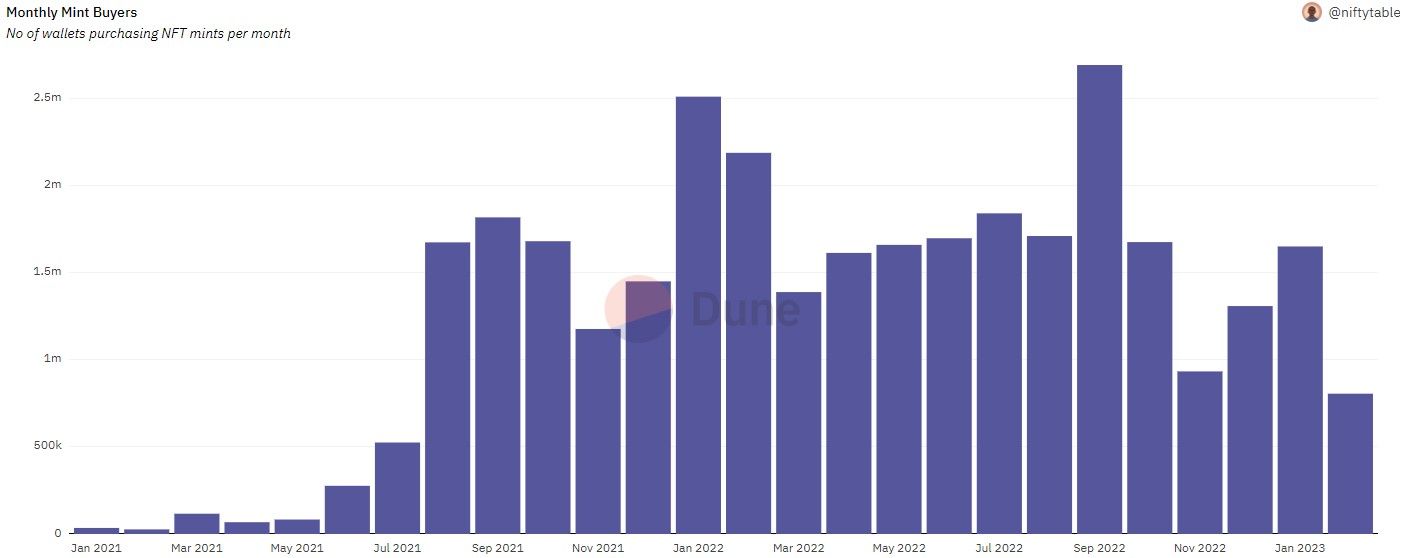

NFT mint volume started crashing after April 2022, but the number of wallets buying mints actually remained stable.

We saw a dip in November. But last month, buyer quantity returned to the April 2022 level.

Note:

- $ values based on the price of ETH at the time of the sale

- The dataset is currently under development so there are still bugs to find and fix

For more insights into the NFT minting landscape check out my Minting Analytics dashboard and give it a star ⭐

Support

If you liked this article, please support the matching Twitter thread. I'd appreciate it 🙂

Subscribe to NiftyTable

Subscribe to the newsletter and unlock access to member-only content.