I crunched the data on Manifold, one of the most popular no-code tools for creating NFT contracts and NFT drop websites.

Here are 5 key insights I found 👇

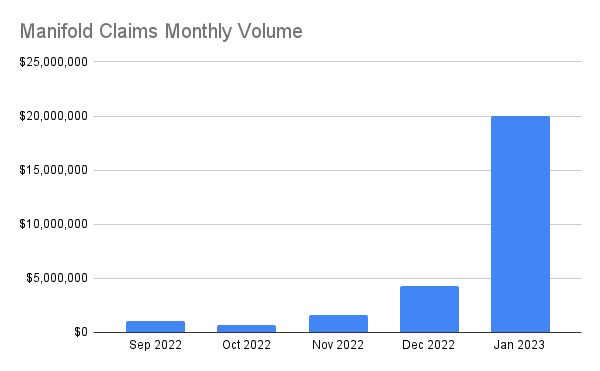

1. Manifold's Claims product makes it easy to create websites for limited edition and open edition NFT drops

223M NFTs have been sold using the Claims tool for a total of $32M

2. Claims saw more activity in January than in all the previous months combined.

156.5k collectors spent a total of $20M.

3. The recent spike in usage was driven by growing excitement around open editions.

Open editions are NFT sale events where buyers can purchase as many NFTs as they want within a set time period.

For example, you could have a drop where collectors can buy as many NFTs as they like for 24 hours, and then no more can be created.

The biggest sale in January was an open edition by NessGraphics called “M0N3Y PR1NT3R G0 BRRRRRR” which made ~$2.2M.

https://opensea.io/assets/ethereum/0x94d676b6550a1a0cee48754a1ad52ecf9edc7013/1

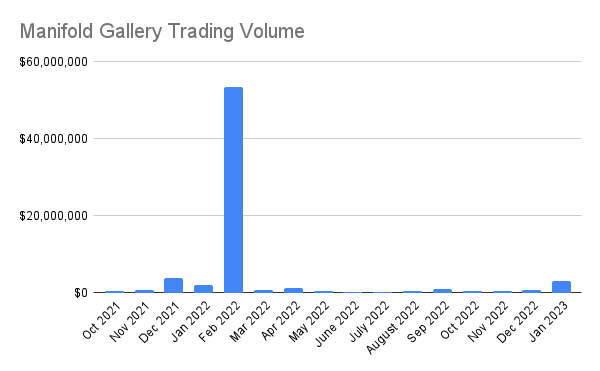

4. Manifold Gallery makes it easy for creators to set up auctions for their work.

Gallery has had $70M in total sales.

Most of that volume is from a huge spike in February 2022 when Manifold Gallery had $54M in sales.

This was caused by the Pak X Julian Assange NFT drop, "Censored".

The "Censored" drop raised money for Assange's legal fees

https://news.artnet.com/market/pak-julian-assange-nft-54-million-2070993/amp-page

Pak's work has had a big influence on Manifold's current success.

The current streak of Open Editions using "burn for reward" mechanics all follow the playbook Pak created with their Fungible Collection.

Fungible Collection NFTs were burned for $ASH which was used to purchase future Pak NFTs

At the time, I predicted that the Fungible Collection would have a long-lasting effect on the NFT art metagame.

It's interesting to see that narrative playing out now.

https://twitter.com/0xKofi/status/1381357600416096256?s=20&t=wF3Q-sAL22rF2F8-RvXUpA

5. Manifold recently announced new plans for monetization. Currently, all the Manifold tools are free.

They plan to charge collectors $1 for every NFT they mint through the Claims product and Burn/Redeem product.

Most NFT platforms monetize by charging a percentage of volume (Opensea takes 2.5% of sales). Creators and collectors like the sound of a flat fee better. $1 doesn't feel like a lot.

Surprisingly, based on historical data, Manifold will make more money off the $1 than they would have made on 2.5% of volume.

As I mentioned before, there have been 223M NFTs minted through Claims. If they had implemented this model from the start, Manifold would have made $223M in revenue by now.

Claims sales volume is $32M. So if they’d charged 2.5% they would have made $816k in revenue.

This gap between the quantity of mints and the volume is the result of the popularity of free claim events.

Note: $ values are based on the price of ETH at the time of sale

Support

If you found this interesting, share the newsletter with a friend or on Twitter!

I want more crypto data insights!

Sign up for my other free newsletter, 0xTrends, for more data on what crypto products and trends are growing fast and why ⚡

Subscribe to NiftyTable

Subscribe to the newsletter and unlock access to member-only content.